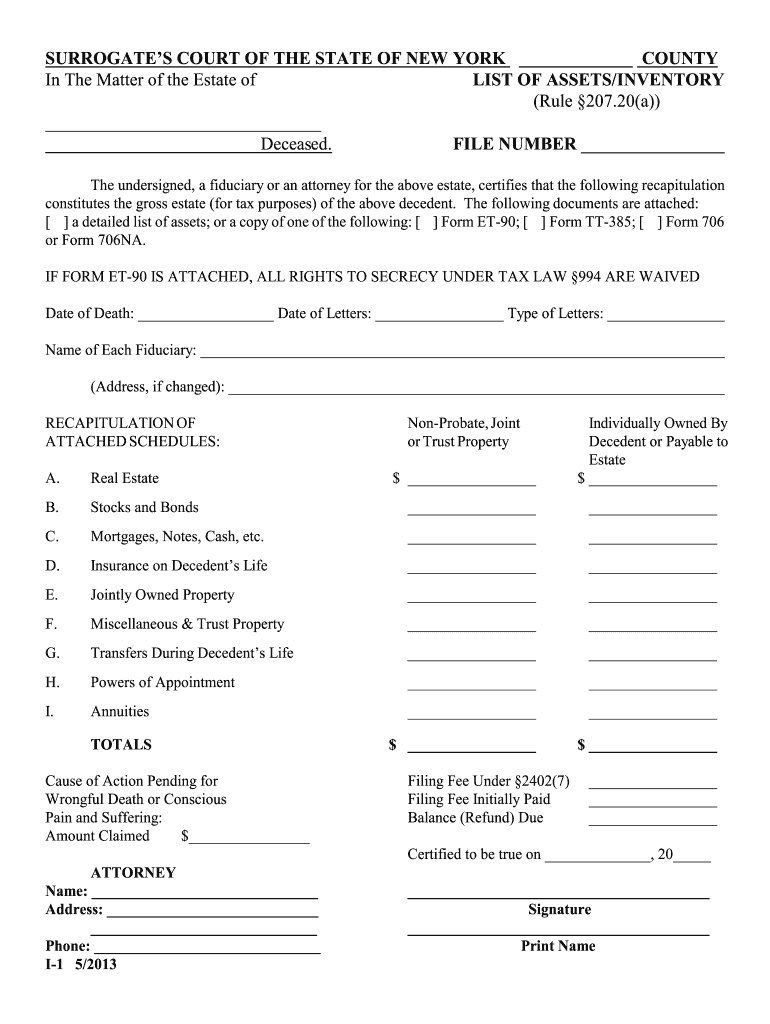

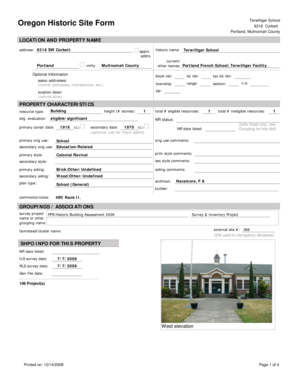

Who needs an Inventory of assets form?

This form is made to be used in the Surrogate’s Court of New York state. The document provides important information about the assets of the deceased person.

What is the purpose of the Inventory of assets form?

This form contains information about the fiduciaries, the deceased, the gross estate (for tax purposes), insurance information, etc. The form is completed by the fiduciary or the attorney for the estate of the deceased. When all the required documents are ready, they are filed with the court to start the probate process.

What documents must accompany the Inventory of assets form?

This form must be accompanied by the detailed list of assets, Form ET-90, Form TT-385, Form 706 or Form 706NA. The check of a paid court fee should also be attached.

Does the Inventory of assets form have a validity period?

This form must be completed by the estate representative not later than nine months after the date of the owner’s death.

What information should be provided in the Inventory of assets form?

The real estate representative has to indicate the name of the deceased, date of death, date of letters and type of letters. He should list all the fiduciaries as well.

The rest of the form should provide the following information:

-

The value and description of the gross assets: real estate; stocks and bonds; mortgages, notes, and cash; insurance on decedent’s life; jointly owned property; other miscellaneous property (individually owned, firearms, trust property); transfers during decedent’s life; powers of appointment; annuities

-

If the decedent’s death was wrongful, the representative must describe the action and indicate the court in which the action is pending and the demanded amount.

The form must be signed by the attorney who should also type the name, address and phone number.

What do I do with the Inventory of assets form after its completion?

The form is filed with the Surrogate’s Court of the New York state. The estate representative should keep one copy for personal record.