NY I-1 2013-2026 free printable template

Fill out, sign, and share forms from a single PDF platform

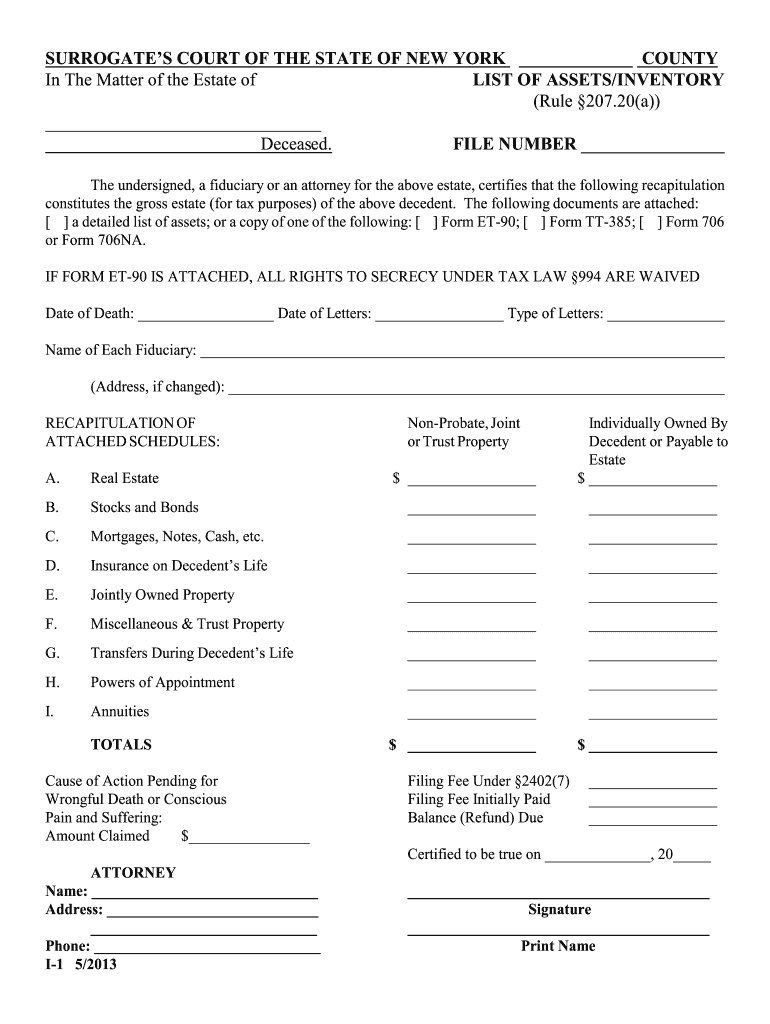

Edit and sign in one place

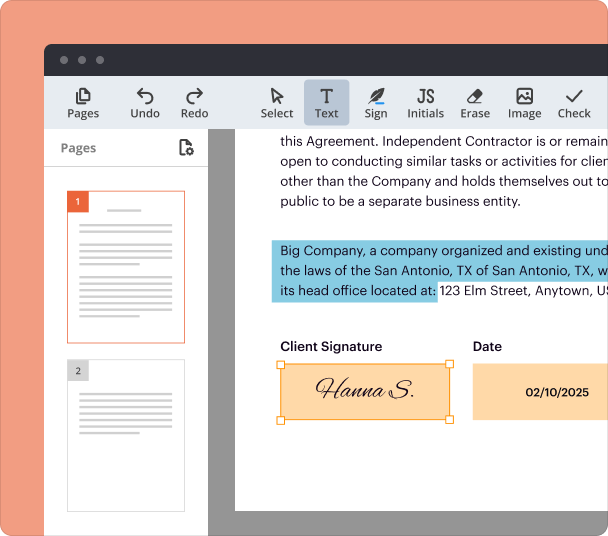

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

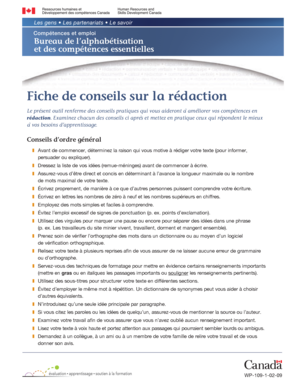

Comprehensive Guide to the NY -1 Form

How to fill out a NY -1 form

Filling out the NY I-1 form requires understanding its sections and providing accurate information about estate assets. This guide will lead you through the entire process while highlighting essential compliance requirements related to estate management in New York.

What is the NY -1 form?

The NY I-1 form, an essential document in estate management, serves as a declaration of assets and liabilities following an individual's passing. It is critical for determining the estate taxes owed and ensuring compliance with New York State law.

-

Purpose: The form helps assess the gross estate for tax considerations.

-

Obligations: Accurate completion ensures that legal and tax responsibilities are met.

What are the essential sections of the NY -1 form?

The NY I-1 form includes vital sections that capture essential information about the estate. Below are the key sections and what they encompass.

-

Essential details about the executor, including name, address, and contact information.

-

A detailed breakdown of the gross estate components to assess taxation.

-

A checklist of required documentation that must accompany the form.

How to categorize assets on the NY -1 form?

Accurate reporting of asset categories on the NY I-1 form is vital for a correct estate evaluation. There are five primary asset categories to ensure comprehensive reporting.

-

Define what constitutes real estate and provide examples including values.

-

Clarify requirements for reporting stocks and bonds and how to document them correctly.

-

Detail which components belong in this category and guidelines for joint property reporting.

-

Report insurance benefits payable to the estate and items to include.

-

Explain reporting requirements for joint ownership and essential documentation.

What are the steps to fill out the NY -1 form?

Successfully completing the NY I-1 form involves following specific, detailed steps to avoid pitfalls. Using tools such as pdfFiller can streamline the process.

-

Collect all necessary information and documents related to the estate.

-

Carefully fill each section of the form ensuring accuracy and completeness.

-

Leverage pdfFiller's interactive tools to simplify the filling process.

-

Double-check all entries for accuracy before final submission.

How to submit your NY -1 form?

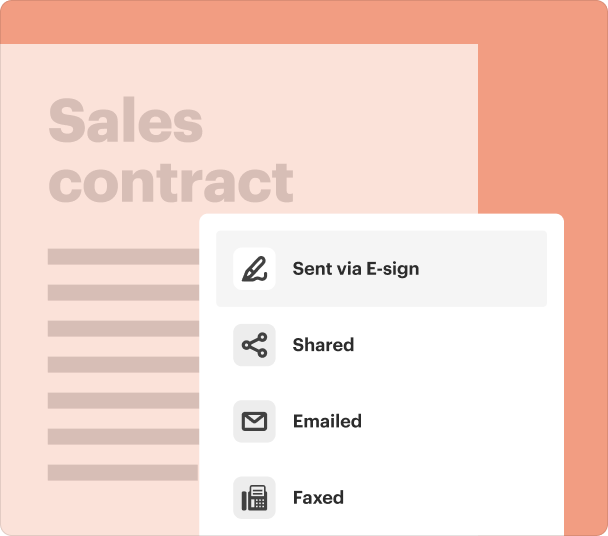

Submitting the NY I-1 form can be done through various methods, including e-filing or paper submission. Each option has its advantages and is subject to specific fees and deadlines.

-

Quick submission process designed to be user-friendly.

-

Traditional method that involves mailing the form to the appropriate office.

-

Understanding necessary fees and payment methods is crucial.

-

Ensure awareness of deadlines to avoid late penalties.

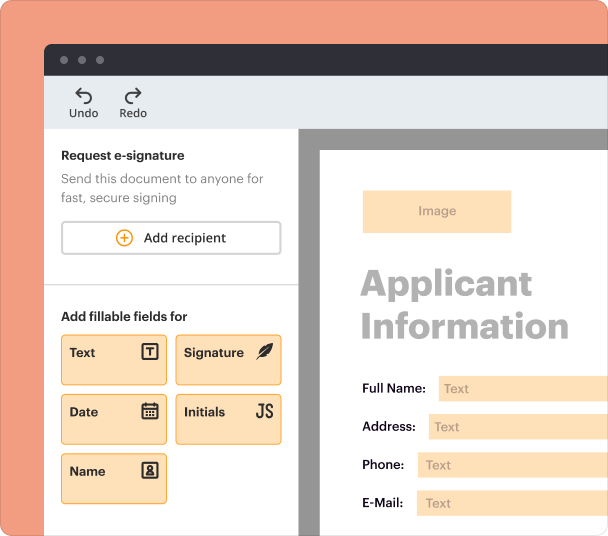

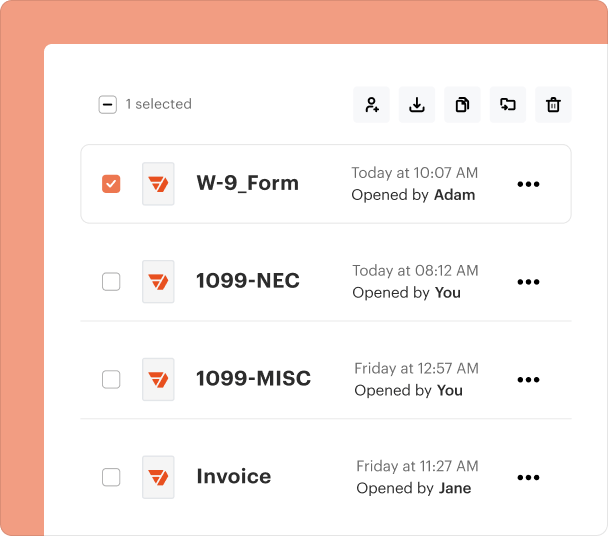

How to track your NY -1 form status?

Once submitted, tracking the filing status is essential. pdfFiller provides features that allow users to monitor their form status effectively post-submission.

-

Get updates on your submission status directly through pdfFiller.

-

Integrate electronic signatures for a quicker processing experience.

What are the tax implications of filing the NY -1 form?

Completing the NY I-1 form correctly can significantly impact tax outcomes. Misreporting can lead to consequences that may be avoided with proper guidance.

-

Understanding tax consequences of misreporting helps in avoiding penalties.

-

Access resources to clarify tax obligations surrounding estates in New York.

-

Consider speaking with tax professionals for personalized assistance.

Why choose pdfFiller for your NY -1 form?

Using pdfFiller creates a more efficiently managed form submission process. The platform allows you to create, edit, and eSign documents seamlessly from anywhere.

-

Edit your NY I-1 form effortlessly from any device.

-

Use secure electronic signatures to enhance processing speed.

-

Manage all estate documents and forms in a single, user-friendly platform.

Frequently Asked Questions about inventory of assets form

What is the NY I-1 form used for?

The NY I-1 form is utilized to report an individual's estate assets for tax assessment purposes. It helps determine the estate taxes owed and ensures compliance with New York State law.

How do I submit the NY I-1 form?

You can submit the NY I-1 form either electronically or via paper submission. Make sure to follow the required processes for each method to ensure successful filing.

What happens if I make an error on the NY I-1 form?

Making an error could lead to penalties or miscalculation of taxes owed. It's crucial to review all information thoroughly before submission or consult with a professional.

Can I track my submission status?

Yes, you can track your NY I-1 form status if you submit electronically. Utilizing a platform like pdfFiller allows you to monitor your submission in real-time.

What supporting documents do I need for the form?

You will need to attach a list of required supporting documents, which may include property valuations, bank statements, and insurance policies related to the estate.

Is there a deadline for submitting the NY I-1 form?

Yes, there's a deadline for submitting the NY I-1 form to avoid any penalties. It's important to keep track of submission dates to ensure compliance.

pdfFiller scores top ratings on review platforms